Making money online sounds great, but the question is, how do you do it ethically? In affiliate marketing, you can earn by simply recommending products you believe in. And this industry is growing faster than ever in India.

According to IAMAI, affiliate marketing spending in India is around $331 million and is projected to exceed $420 million by 2025. This rapid growth means more opportunities for affiliates to earn, but it also brings greater scrutiny from regulators. New tax rules and compliance requirements are being introduced to ensure the industry operates transparently.

Understanding these rules is essential to ensuring your affiliate campaigns run smoothly and without any legal trouble.

This blog breaks down everything you need to know about the laws, taxes, and compliance related to affiliate marketing in India. Let’s get started!

One of the first questions many new affiliate marketers ask is: Is affiliate marketing legal in India? The answer is a clear Yes. Affiliate marketing is completely legal and recognized as a legitimate business activity. As long as you follow general business laws and tax rules, you can run your affiliate marketing business safely. Here are important legal points you should remember:

One of the first questions many new affiliate marketers ask is: Is affiliate marketing legal in India? The answer is a clear Yes. Affiliate marketing is completely legal and recognized as a legitimate business activity. As long as you follow general business laws and tax rules, you can run your affiliate marketing business safely. Here are important legal points you should remember:

By following these simple guidelines, affiliate marketing remains a safe and legal way to earn income in India.

If you earn money as an affiliate by running affiliate campaigns, you are considered a digital earner or freelancer under Indian tax laws. Your income is taxable if you are a resident of India, even if your payments come from foreign companies.

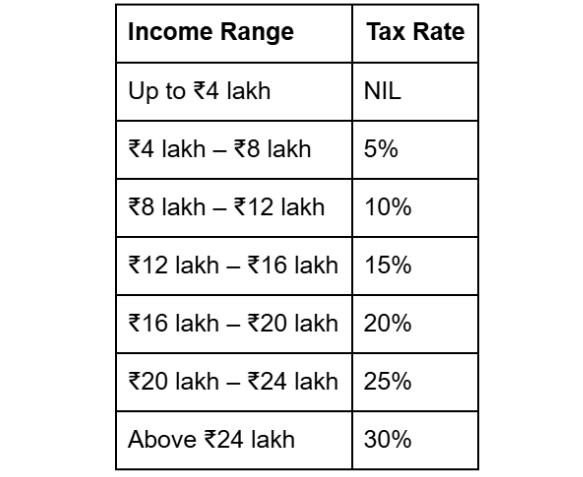

Any individual or entity earning through affiliate marketing must pay tax if their annual income exceeds the basic exemption limit of ₹2.5 lakh for individuals below 60 years of age. Even smaller earnings should be tracked carefully for proper compliance.

Affiliate income is classified under Profits and Gains from Business or Profession (PGBP). This means you are treated like a small business owner for tax purposes. That means you need to file income tax returns using ITR-3 or ITR-4.

If your total tax liability exceeds ₹10,000 in a financial year, you must pay advance tax quarterly.

You must maintain detailed records of all income and expenses unless you opt for a simplified scheme (note: affiliate marketers are generally not eligible for presumptive taxation under Section 44ADA).

Presumptive taxation is a simplified method meant for professionals such as doctors, lawyers, and consultants. Affiliate marketers are NOT eligible for this scheme, so you need to calculate your actual income and expenses in detail.

You can lower your taxable income by claiming business-related expenses, such as website hosting fees, internet bills, marketing tools or software subscriptions, equipment like laptops, cameras, or smartphones, and travel and other content creation costs. Make sure to keep proper invoices and receipts for all expenses claimed.

Note: If your total income is up to ₹12 lakh, you can claim a rebate of up to ₹60,000 under Section 87A, effectively meaning no tax liability up to ₹12 lakh under the new regime.

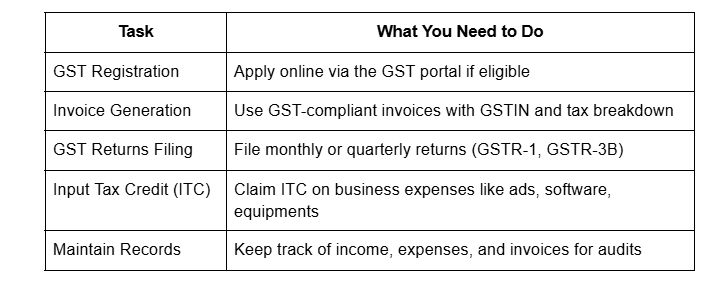

GST (Goods and Services Tax) is a tax on income earned from providing services. As an affiliate marketer earning commissions by promoting products or services, you may need to register for GST and follow certain compliance rules.

You must register for GST if any of the following apply to you:

If your income is below ₹20 lakh, you still need to register if you’re involved in inter-state or international business.

The standard GST rate applicable to affiliate marketing services is 18%. This applies to your commissions, payouts or any income earned from promoting products or services online.

If you receive free products or services as payment (instead of cash) for your promotions, GST still applies. You must pay GST based on the fair market value of what you received.

If you purchase services from unregistered vendors, such as freelance designers or video editors, you may have to pay GST on their behalf under the Reverse Charge Mechanism. This means you self-assess and pay GST directly to the government.

Using billing and accounting software like CaptainBiz or ClearTax can automate your GST invoicing and filing process. You can also use online GST calculators to estimate your tax liability quickly.

Failing to register for GST or not filing your returns can lead to penalties up to ₹10,000 or more, losing the right to claim Input Tax Credit, or delays or withholding of payouts from affiliate networks.

GST compliance may sound complicated, but with proper planning and the right tools, you can stay fully compliant and keep your affiliate business running smoothly in 2025.

The affiliate marketing industry in India is expanding fast, and with growth comes the responsibility to stay updated on laws, taxes, and compliance. At vCommission, we make sure our affiliates have the right information and support to stay on the right side of the rules like contracts, honest disclosures, or respecting brands policies.

We know taxes and GST can feel complicated, but keeping good records and understanding what expenses you can claim makes a big difference. If your earnings cross certain limits, registering for GST might be needed, and it’s always a good idea to check with a tax expert if you’re unsure. Our focus is to keep things transparent and simple for our affiliates with clear reports and timely payments, so you can spend your energy growing your business without worrying about the legal stuff.

Staying informed and following the basics will help you run your affiliate campaigns smoothly and build trust with your audience. That’s what really matters in the long run.